All Categories

Featured

Table of Contents

It took some time for this banking principle to create. Everything drew back in the late 1800s. In 1871, Carl Menger, the owner of the Austrian Institution of Business economics, released his very first publication, Principle of Business economics, in which he criticized the classical theory of business economics that was generally held at the time and gave an alternate means of considering business economics.

The subjective concept of value locations worth on just how limited and useful an item is as opposed to basing the value of the item on just how lots of sources and hours of labor entered into creating it. To put it simply, individuals value money and goods in a different way based upon their financial condition and needs.

Infinite Banking 101

You can fund major life expenditures such as Your youngster's education Downpayment on the home Medical costs Automobile or student car loan Way of living Banking is even more of a long-term play and financial investment you can not get rich with this system over night. It is a vehicle that will certainly obtain you to your destination.

As a matter of fact, the limitless banking idea revolves around an entire life insurance plan. If you were to ask just how crucial life insurance policy remains in maintaining the system running, we would certainly state: It's essential. It is critical to keep in mind that boundless financial is NOT entire life insurance policy. It is a device that can be made use of to reproduce the banking system utilizing your own cash and is one of the reasons that boundless financial jobs.

Term life has no cash worth either, to make sure that is a certain no-go. However below, we compare entire life and global life just for you to see the distinctions: There are a lot of other life policies individuals want since they do not want to switch over, yet none can be effective for by doing this of generating income.

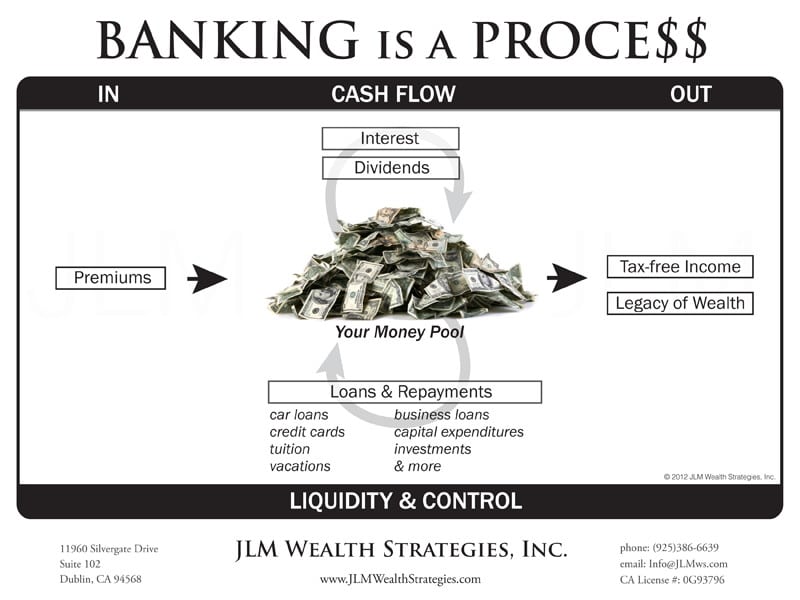

Every time you make a superior payment, a part of your settlement is put towards a savings section of your plan called cash worth. With each premium payment, the cash money worth collects at a tax-free rate and can be made use of as needed and as you see fit. The factor is that the cash money is your own.

How To Create Your Own Bank

The cash can be accessed either with a withdrawal or a funding it is very important to comprehend that these are various things. The advantage of accessing it with a funding is that it does not disturb the compound passion in the policy. With a life insurance policy plan, after the insurance holder is gone, the beneficiaries of the policy will certainly obtain an assured quantity of cash that will aid them fund significant life costs.

Your plan's money worth is the amount of your survivor benefit that the insurance coverage company is making payable to you. If you were to cancel your plan while still living, the cash value is the amount the life insurance plan supplier normally pays you. But once again, as long as your policy premiums are paid, both the money worth and stated value can be used for a vehicle or pupil car loan with your policy as collateral.

This is not to state you can not or shouldn't have actually properties tied to the stock market. With the guaranteed yearly cash money value cost savings section growth, it gives a much more steady means to handle your financial resources in a world that does not always use that security. When you use your insurance coverage, you immediately boost your capital and liquidity.

If you pass away with cash left in either of your qualified 401(K) or IRA, yes, the remaining funds will certainly still be passed onto your beneficiary. It will certainly be strained as common income (the highest possible exhausted kind of income). While there is still a guarantee that your beneficiary will get something, you can not assure the amount due to future tax obligation prices.

Returns got from the insurance business that is offered to the insurance policy holder on a yearly basis are likewise not taxed. infinite banking nash. These are several of the manner ins which the IBC provides you a tax obligation benefit and benefit contrasted to banking in an extra typical sense. A properly-structured taking part entire life plan gives many incredible warranties

For now, let's concentrate on the qualifications required for entire life insurance policy. If you are wanting to apply for whole-life insurance, you might have to finish a medical examination to determine life span based upon health tiers. As soon as you are analyzed for health, your rate stays the very same for the remainder of your plan, which indicates the much healthier and more youthful you are, the more affordable your plan may be.

What Is Infinite Banking Concept

This will certainly allow you to receive a reduced premium that will certainly stay the very same for the entirety of the life plan. When requesting life insurance policy with health and wellness issues, it is helpful to have alternatives and pick a company that you are more probable to be accepted by. Again, speak to your life insurance policy representative to see what alternatives are best for you and your particular scenario.

Infinite Financial is a tested principle for expanding and shielding generational riches. It is not always thought about the norm or simplest method to fund, such as 401K or IRA economic plans are often seen. Infinite Banking is a chance to level up and transform your way of thinking and individual development, and development when it comes to your economic objectives.

Being an honest lender likewise implies being truthful with yourself concerning your monetary objectives and the actions you will certainly take to arrive. The unlimited financial principle is except the fatigued, nevertheless, if you have the right technique and frame of mind, it can be attained. Infinite Banking is not about pleasure principle.

I am certain you have learnt through financial advisors that it is very important to diversify our assets and not place them all in one place. Among the cons of the infinite banking concept is that you are putting all of your properties in one location, thus not expanding them.

This doesn't suggest your money will not expand, we understand it expands in the entire life insurance policy plan, however it is just expanding in one location instead of having a diverse portfolio. Since all your money is only in your entire life plan, you are breaking among the lessons you have actually most likely heard that you require to diversify your possessions.

Here is a diversity factor we 'd like to make about the Infinite banking principle: "If you are exercising infinite financial, you are using your whole life insurance policy as a property to borrow against for the acquisition of various other assets. As you are doing this, you are participating in diversity by acquiring cash-flowing possessions" Considering it in this manner, we would certainly likewise say that you are still expanding your assets, just not similarly as if they were tied to the supply market.

Whole Life Insurance Cash Flow

Compared to label life insurance coverage, the premiums for entire life insurance policy are dramatically higher. Whole life may not be the very best alternative for somebody who is living paycheck to income. However, it is vital to be mindful that with entire life insurance policy, you are not just paying for insurance coverage. You are functioning toward placing a specific quantity into "a savings account" in your insurance plan, which you can make use of nevertheless and whenever you desire.

Finally, there are several pros and cons to consider when deciding to utilize your policy to produce an infinite financial technique for you and your future. The pros much outweigh the disadvantages, and with the appropriate certifications, attitude, and self-control, any individual can make use of a limitless financial concept throughout their whole life to maintain control and possession of their financial resources and develop generational wide range.

Let's see if it works for you. If you are still unsure if it is ideal for you, below are some things to consider. Infinite Financial provides a guaranteed return on money. Infinite Financial provides fixed costs throughout your whole life insurance plan Infinite financial produces financial access through your cash money value that you can use prior to fatality.

Collaborating with an insurance specialist is the finest way to determine the ideal plan for you. To get one of the most out of the system's many benefits, the ideal plan needs to be established in a particular means. There are several moving components and things to consider. Finding an insurance company that meets your particular needs and goals is crucial.

Latest Posts

Review Bank On Yourself

Be Your Own Bank: Cash Flow Banking Is Appealing, But ...

How To Be My Own Bank